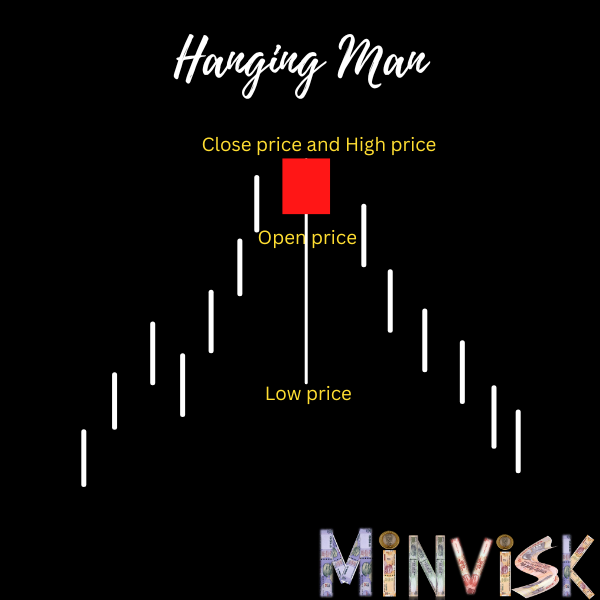

As we have discussed from the previous module, The hanging man is a candlestick pattern that shows up when an uptrend might be turning around. Imagine a small candle with its top near the top, and a long tail hanging down, at least twice the size of the candle. This is the hanging man, and it suggests a possible shift from an uptrend to a downward one. It is said hanging man because it looks like person hanging when it occurs during an uptrend.

It has been observed that the color doesn’t play a significant role in this pattern. The below image will make things clearer.

Below features of hanging man which we have also discussed in the previous module (Umbrella lines) has been laid for your revision

Small Real Body: Small real body is located at the top of the candlestick. The color of the body is not as significant as its position in the overall pattern.

Long Lower Shadow (Wick): It has long lower shadow, which extends below the body. This shadow shows the difference between the lowest price and the closing price.

No or shorter Upper Shadow: The upper shadow, if present, is typically very short or non-existent.

Remember, although a hanging signals shift in the market towards a bearish trend, it’s crucial to wait for confirmation through ongoing price movements. Traders usually watch for continued selling in the next few trading sessions to solidify the potential trend reversal. Always keep in mind that using additional technical indicators and considering various factors can give you a more complete picture of market conditions when analyzing candlestick patterns.

Psychology behind this pattern:

Long Lower Shadow (Wick) indicates that Open price, close price and High price are very close to each other (same has also been shown in above diagram). This indicated weakness in people indecisiveness. It suggests that buyers were initially in control, pushing the price higher and higher. However, during the trading session, sellers managed to push the price down significantly before the close as we can see in above image. Long lower shadow shows that inspite of positive trend, there is significant selling pressure and it is difficult to maintain the uptrend or its uptrend momentum further.

How to Identify Support with Hammer Pattern

The highest point or high price of the real body of the hanging man can act as a potential resistance level as it indicates sellers’ interest and buying losing their interest. It indicates that the price will not rise beyond it and if the price falls below the resistance level formed by the hammer, it provides an additional confirmation that the pattern is meaningful.

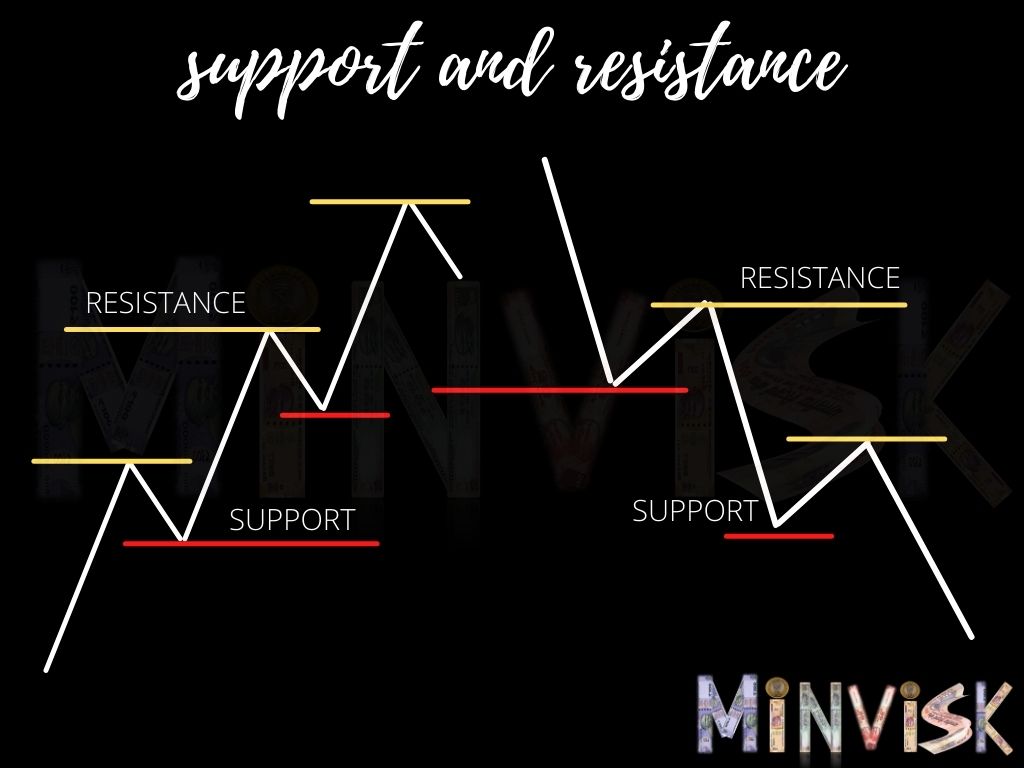

The resistance level below the high of the hammer candle will work fine and it is considered as crucial resistance zone and if price rise beyond this price, this mean it is fake reversal and trend reversal will not likely to happen. The price zone that was support zone during the uptrend may now act as resistance zone after the Hanging Man forms. This is a common concept in technical analysis known as “support turned resistance.” Which have also discussed in our previous module.

I hope you find it intriguing. In the next module, we will learn more about such patterns in coming modules.