The Bullish Engulfing pattern is a widely recognized combination of two or more candles, commonly observed for trend reversal. There are two variations of this pattern: the Bullish Engulfing pattern and the Bearish Engulfing pattern.

Bullish Engulfing pattern

The bullish engulfing pattern occurs during a downtrend and consists of two candles. The first candle is a smaller red (indicates bearish) candle, followed by a green candle (indicates bullish) that completely engulfs the previous candle. It indicates that buying pressure is more than selling pressure i.e. BUYING PRESSURE>SELLING PRESSURE. For more clearer understanding, please refer below image-

As seen in the image above, the real body of the red candle is fully engulfed by the green candle’s real body. It’s crucial to note that the covering or engulfing of the shadow is not significant; the emphasis is placed on the real body.

It suggests change in market sentiment from bearish to bullish. It indicates that buyers have overwhelmed sellers, leading to the potential reversal of the downtrend.

Bearish Engulfing pattern

The bearish engulfing pattern occurs during an uptrend and consists of two candles. The first candle is a smaller green (indicates bullish) candle, followed by a red candle (indicates bearish) that completely engulfs the previous candle. It indicates that selling pressure is more than buying pressure i.e. BUYING PRESSURE<SELLING PRESSURE. For more clearer understanding, please refer below image-

As seen in the image above, the real body of the green candle is fully engulfed by the red candle’s real body. It’s crucial to note that the covering or engulfing of the shadow is not significant; the emphasis is placed on the real body.

It suggests change in market sentiment from bullish to bearish. It indicates that sellers have overwhelmed buyers, leading to the potential reversal of the uptrend.

The key features of the engulfing pattern are as follows:

- There should be a clear uptrend or downtrend; this pattern is not effective during market consolidation.

- The second body must entirely cover the preceding real body, while engulfing the shadow is not necessary. The greater the depth of the real body engulfed by the larger candle, the more robust the pattern.

- The second body must have the opposite color. If the first body is red, then the second body must be green, and vice versa.

In practical terms, volume plays a crucial role in this pattern. The higher the volume during the second candle, the more robust the potential trend reversal. Please don’t ignore the analysis of volume as significant increase in volume during the engulfing pattern strengthens the signal.

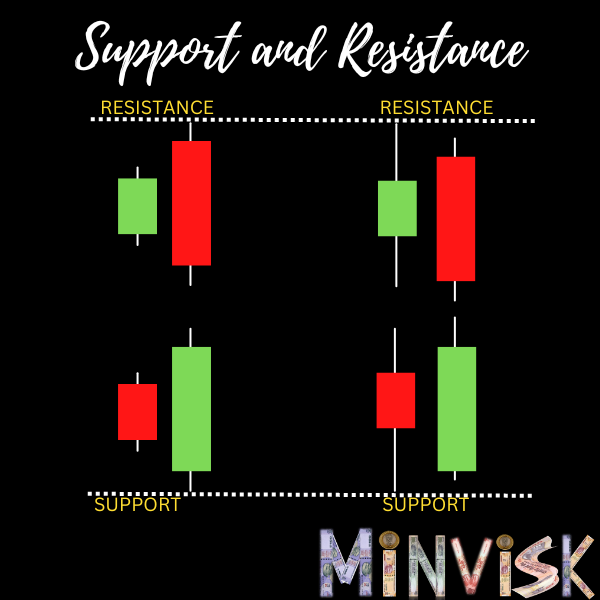

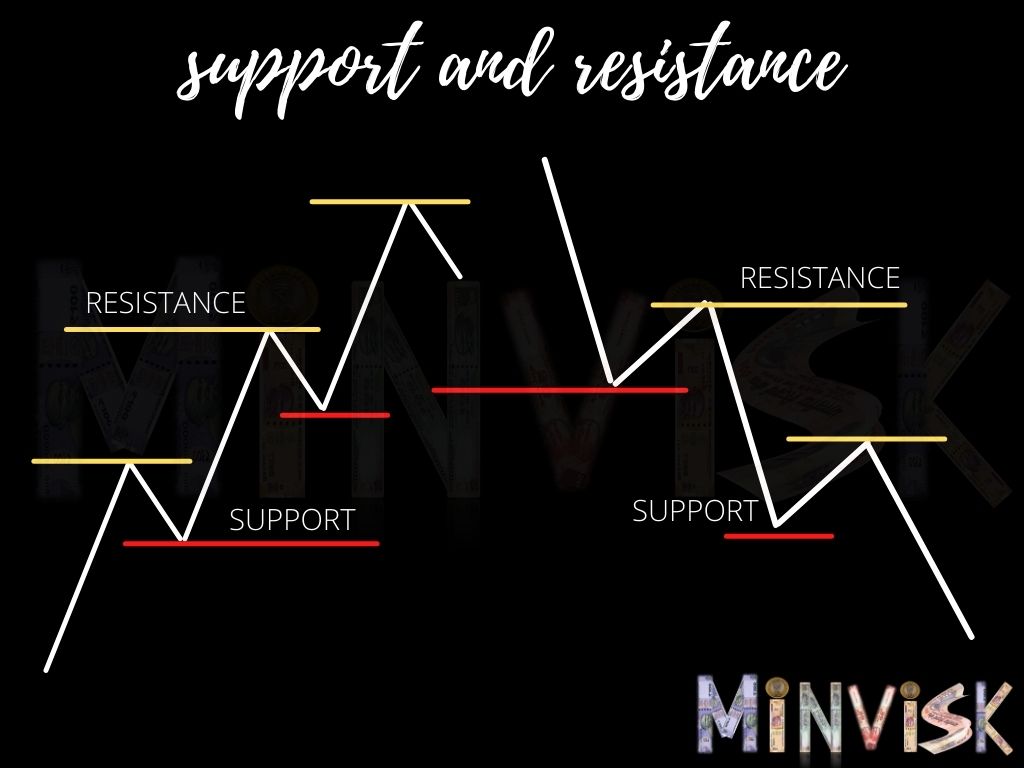

It provides good support and resistance level as clearly indicated in below image-