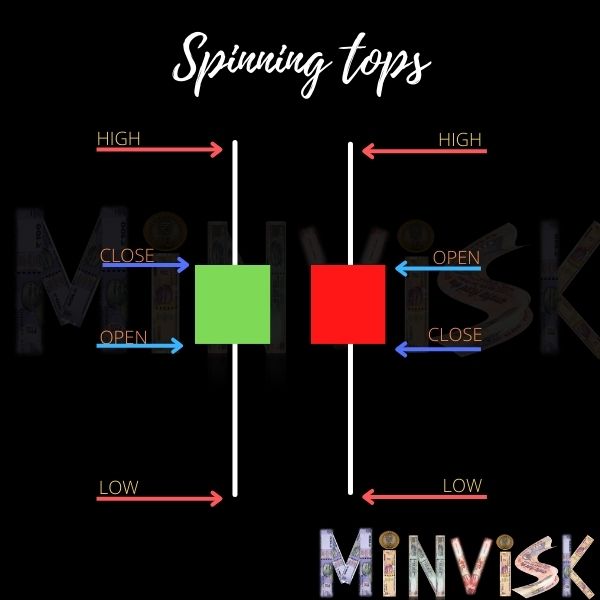

Doji is very important pattern and it will be used in explaining other patterns in upcoming module. Doji shows market indecision and a potential reversal of the trend. Doji is formed when the opening and closing price is very close or same, resulting in a small or non-existent real body. It indicated that neither buyers (bull) nor sellers(bear) were able to gain control and it has created the environment of uncertainty about the future. It has similar use like spinning top as it also provides indication for possible market reversal.

The image below will clarify this pattern in our minds.

Characteristics of Doji –

Small or non-existence real body – Doji has small or non-existent real body, indicating small or little price difference between the opening and closing prices. This shows weak price action in the market.

Long and Upper Shadows – It has long upper and lower shadow, it indicates that there is huge price range between the high and low during the trading period. Hence, it indicates confusion among the buyers (Bull) or sellers (Bears) and no one is able to take control over the market.

Indication –

Indecision – The Doji shows tussle between buyers (bull) and sellers (bear), resulting in indecision about the future direction of the market. It shows that neither the bulls nor the bears were able to dominate the trading session, leading to a relatively small net price change.

Potential reversal signal – standalone, itself doesn’t provide a strong signal, it becomes more impactful when it occurs after a strong price movement. It may indicate potential exhaustion of the prevailing trend and a possible reversal when it appears during uptrend or downtrend.

WARNING: Practically, it has been seen that confirmation from the upcoming candlestick is required to confirm the reversal of an uptrend or downtrend.

We will discuss Doji in detail in an upcoming module. We have not covered other types of Doji because it is not necessary at this point. Only a basic understanding of Doji is required to comprehend the upcoming candlestick patterns or charts in upcoming modules.