Japanese candlestick charts are visually insightful method of representing price movements in financial markets. It is Developed in Japan in the 18th century, these charts have become a widely used tool for traders and analysts worldwide.

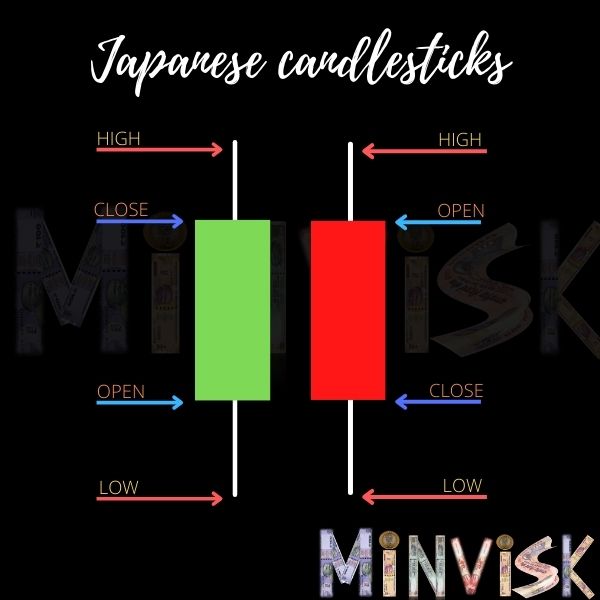

Components of candlestick:

Open: The price at which the market opens during the specified time frame.

Close: The price at which the market closes during the specified time frame.

High: The highest price reached during the time frame.

Low: The lowest price reached during the time frame.

Each candlestick represents specific time frame that can be 15 minutes, 1 hour, 1 day or 1 year. The body of the candlestick is coloured green for bullish (upward) trend and red for bearish (downward) trend.

The green candle is formed when the closing price is higher than the opening price within a given time frame. It signifies that the price has increased, indicating a bullish movement. On the other hand, the red candle is formed when the closing price is lower than the opening price for the specified time frame. The red candle suggests that the price has decreased, signifying a bearish movement. The above discussion become more clear from the below image.

(Image)

The real body is the core of the price movement, indicating whether it’s a bullish or bearish trend. Think of it as the market’s barometer. As a trader, pay close attention to the opening and closing prices because these are two emotionally charged points during the trading day. Here’s a helpful tip for new traders: consider avoiding trading in the first 15 minutes of the morning. This time is often hectic with a lot of rush, anxiety, and news, making it a period of heightened activity. During the initial minutes of trading, the market can experience increased volatility and unpredictability as traders react to overnight news and other factors. Waiting for the initial rush to settle down can provide a more stable and rational trading environment for those who are new to the market.

Their can be different types of candlestick patterns such as –

Single Candlestick Patterns: These include basic patterns like the doji (indicating indecision), hammer, and shooting star, each providing insight into market sentiment.

Multi-Candlestick Patterns: Patterns like the engulfing pattern and the harami involve combinations of multiple candlesticks and can signal potential trend reversals.

Don’t worry, we will discuss all this patterns in upcoming module.