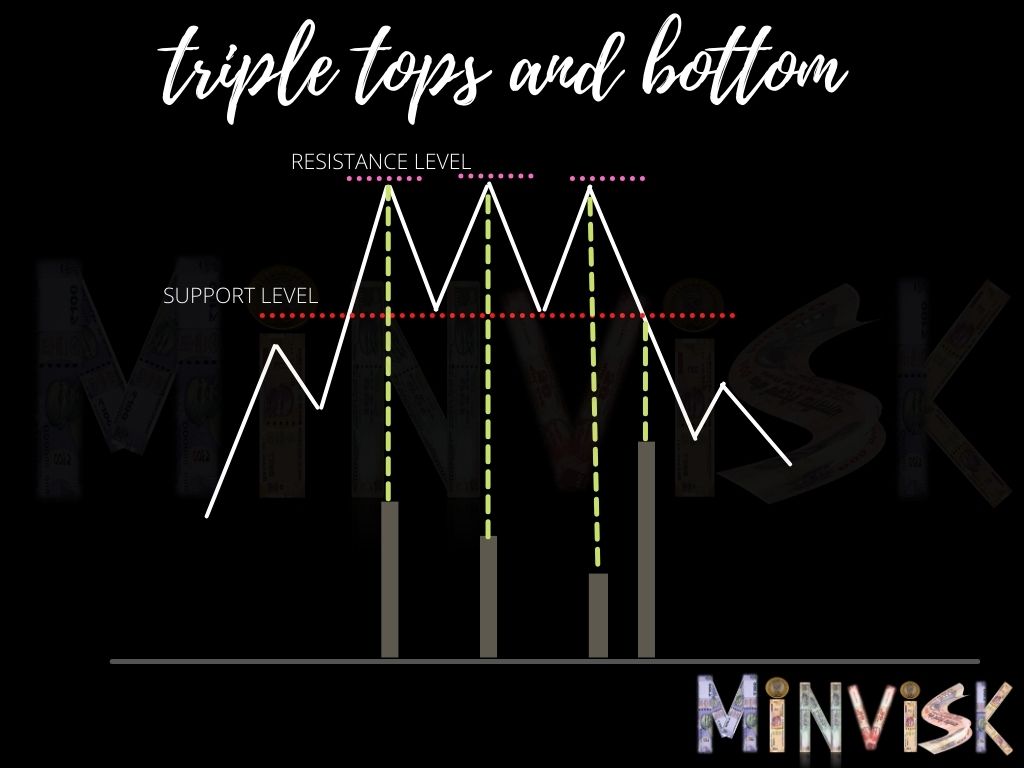

Triple tops and bottom is the slight variation of the head and shoulder, it is advisable to know about head and shoulder before understanding this pattern.

From the above image, we can see 3 peaks at the same resistance level, not like head and shoulder in which each peak is at a different price level, this indicates that extreme selling pressure at this level. The volume will keep on falling till we reach the 3rd peak i.e VOLUME(FIRST PEAK)>VOLUME(SECOND PEAK)>VOLUME(THIRD PEAK).

Here we also need to focus on the support level, price is not able to fall below this level because of buying pressure at this price and this pattern will complete when the price will break this support level( as the neckline is broken in head and shoulder). At this level, the volume should be huge because at this level selling pressure is greater than buying pressure.

The trader should wait for the pattern to be complete because if the support level is not broken with a huge volume, the price can bounce back and continue with the uptrend.

In real situations, such support and resistance level doesn’t need to be formed at the same price for each peak, slight variation in such levels is fine but larger variation should be avoided.

We stumbled over here different website and thought I might check things out. I like what I see so now i am following you. Look forward to looking over your web page yet again.